Successful Financial Literacy

Freshman Get Approved for Car Loans

Submitted by Rob Kinch

Relax, parents. No, the state of New Jersey has most certainly not lowered the driving age to include fourteen-year- olds. These teens have, however, raised their collective awareness of all the necessary components that go into successfully securing that much needed loan to help finance (at long last) their goal of transportation freedom. Dispelling their hopes of securing that magical ‘co-signer’, much like those fruitless hopes of a snow day on the eve of a major Math test, the realities of such foreign concepts as credit scores, debt-to-income ratio, and interest rates would now have to be recognized and seriously addressed in their collective financial planning, to ensure that comfortable faux-leather seated reign behind the wheel.

Tasked with the challenge of applying for and receiving approval for automobile financing, eighteen Rahway High School 9th graders, students from one of the high school’s Freshman Seminar classes, quickly discovered there was considerable investigative work to be done before putting hopeful pen to paper. The premise was established that they were 22 years old, living on their own, maintaining full-time employment (with a realistic salary), and carrying a reasonable amount of student debt. Students then researched college tuitions, student loans and their respective repayment structures, housing and food costs, day-to-day expenses, auto insurance costs and the like. Armed with an arsenal of pertinent information, they were then ready to take the next step and secure a financial ‘partner’. But who?

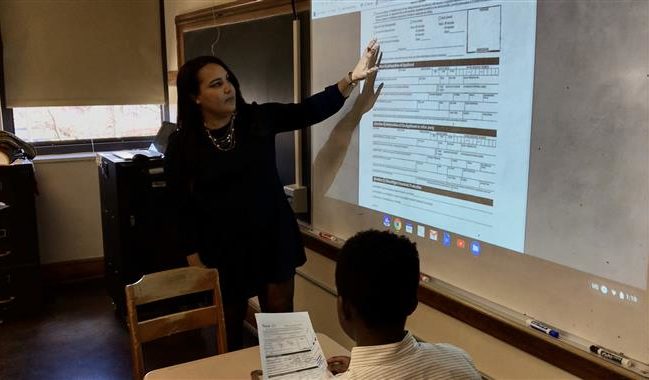

Their hopeful link to the open road (and to reality) quickly arrived in the persona of a savvy, supportive, and surprisingly endearing representative from the black and white world of banking. Ms. Dhana Reynoso, Manager of the Fair Lawn Branch of Columbia Bank, visited their class to review their painstakingly prepared applications and to proclaim, albeit amusingly, her official thumbs-up or down to their respective financial requests. As students sheepishly volunteered to have their applications reviewed before the class (along with their high school Principal and two Vice Principals sharing their trepidations on the sidelines), Ms. Reynoso took this excellent opportunity to impart a lesson on the necessity of maintaining a healthy personal financial profile while offering insight into the concept of the ‘debt to income’ ratio utilized by banks in making loan decisions. (Students can now tell you it’s 43%.) After being enlightened by their banker’s step-by-step explanation, students clearly understood why only 2 out of their class of 18 would be able to head post haste (figuratively speaking of course) to a dealership!

“Before this experience, I had no idea of the different attributes that went into purchasing a car or even applying for a car loan,” admits freshman Joshua Munoz. “Learning how to calculate your own debt-to-income ratio will definitely stick with me.”

Devin Torres honestly offers, “I was afraid for my future and how I was going to hold up against the struggles.” He adds, recognizing the value of Ms. Reynoso’s advice, “When Dhana walked into the room, she showed us an easier path to success.”

The value of her financial insight was also underscored by Emily DeBello. “The whole class was lucky enough for this experience because, during Ms. Dhana’s presentation, she said she wished she had had this type of information when she was in school!”

Jaydin Lopez most definitely agrees. “Opportunities like this don’t appear for many, so this experience is really a once-in-a lifetime thing.”

As part of Columbia Bank’s corporate mission to provide outreach to students to promote financial literacy, Ms. Reynoso was eager to engage Rahway’s high school students in constructive dialogue to heighten their awareness of the crucial need to prepare themselves for the financial responsibilities they must assume going forward.

“Having such a warm and welcoming reception by the students and seeing their appetite for learning, gave me even more of a desire to provide them with the knowledge to help them succeed,” admits ‘Ms. Dhana.’ She continues, “Each person I met at RHS treated me with such kindness and with such an open heart; I was especially touched by how the students truly embraced the experience.”

Having been an integral part of the vision and development of the Freshman Seminar Program at RHS nearly 10 years ago, current Vice Principal Maria Hennessy found Ms. Reynoso’s presentation “very informative” while adding, “Her knowledge about the topics at hand reinforced recent classroom discussions about budgeting practices. This ‘real life’ example was a true demonstration of where our students will be in a few years, post high school.”

Vice Principal Chey Rivera complimented ‘Ms. Dhana’ on her ability to “truly connect with the students”, citing that the students “walked out with the firm knowledge that ‘money doesn’t grow on trees’ and that even when one has a solid income, adult financial responsibilities can be eaten up with the mere day-to-day necessities of living!”

RHS Principal John Farinella offered Ms. Reynoso his sincere appreciation for her presentation, making sure she knew a return visit would definitely be a most welcomed one.

Content in the knowledge that only he and another classmate were granted approval, if only in theory, for financial lending, freshman Ibrahima Diawara did not miss a beat to acknowledge what he considered the definite down-side of his fortune. “Now this gave me one more thing to worry about…my debt to income needs!”

Photos by: Joseph Mudrak